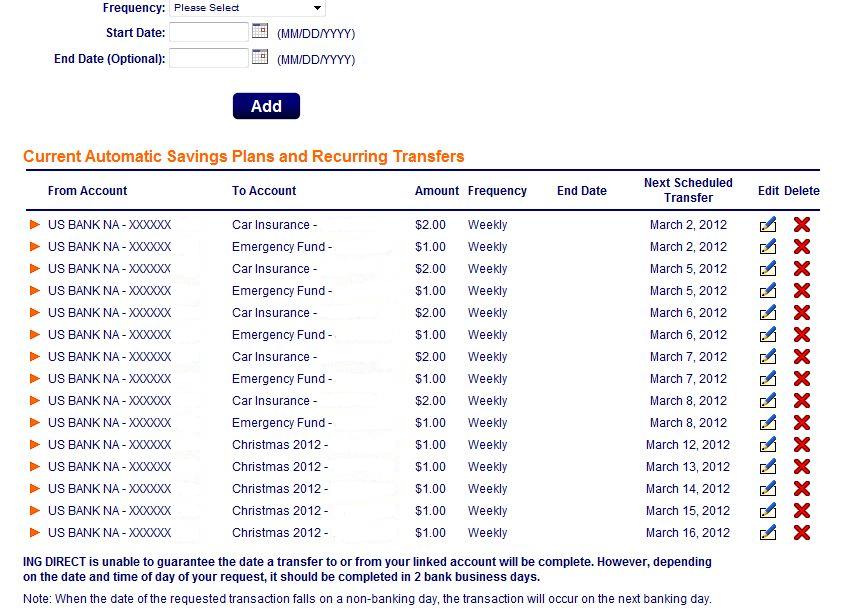

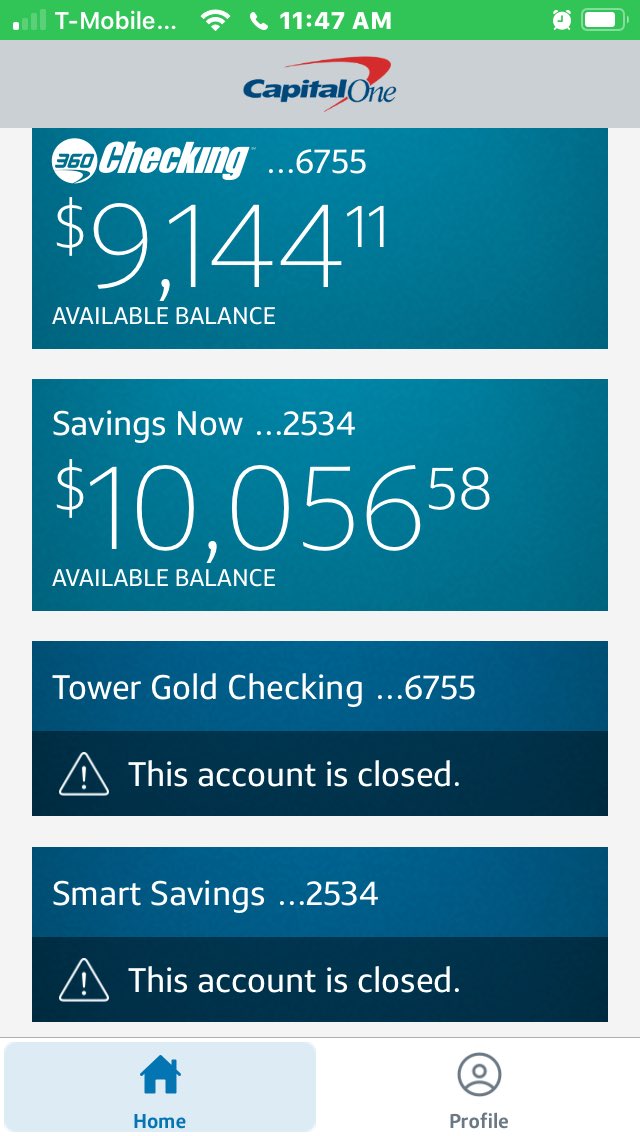

Always make sure that you're looking out for fees!Ĭan you lose your money in a money market account? Some may charge monthly maintenance fees, especially if you don't keep the minimum balance required. Money market accounts are offered at banks, credit unions, and even some brokerage firms. Yes! Money market accounts are FDIC insured.Īre money market accounts offered only at banks? With a money market account, you can deposit and withdrawal your money at any time. What's the difference between a money market and a CD?Ī CD is a banking product that has a structured term, and you must keep your money in that CD for the term in order to get your interest payment. What I love about capital one 360 is that I get the interest rate of an online bank but I have branches near me in New York where I can deposit cash or. The big difference is that a money market account typically pays a little bit higher interest, but it also typically requires a slightly higher minimum balance. Both accounts are FDIC insured, both have limits on how many checks and transfers you can do, and both are offered by banks, credit unions, and investment firms. There is very little difference between a savings account and a money market account. What's the difference between a money market and savings account? Here's our FAQ on money markets based on some of the common questions we get.

It was true back in January 2006, and it’s still true today. Really, the difference is so much that it’s not even a fair comparison.

Due to much lower overhead and scale, online banks typically offer much higher interest rates on savings vs. All products and services are presented without warranty. Pros of Capital One 360 Money Market / Savings. Theres no minimum deposit required, but you must have some type of balance to consider the account. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product's website. Capital One 360 money market accounts earn 0.50. strives to keep its information accurate and up to date.

CAPITAL ONE 360 MONEY MARKET RATES FULL

And our partners can never pay us to guarantee favorable reviews (or even pay for a review of their product to begin with).įor more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. The College Investor does not include all companies or offers available in the marketplace. has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. We're proud of our content and guidance, and the information we provide is objective, independent, and free.īut we do have to make money to pay our team and keep this website running! Our partners compensate us. Money market funds are not insured by the FDIC or the NCUA, which means you could possibly lose money investing in a money market fund.There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. Credit Union 1 American Express Discover Capital One 360 Sofi Money National Average Citibank PNC Bank Wells Fargo Chase Bank of America Fifth Third BMO. Money market funds are offered by investment companies and others. Your bank or credit union may also have a minimum deposit that it requires to open a money market account.Ī money market account is different from a money market mutual fund, or a money market fund. Withdrawals or payments by ATM, in person, by mail, messenger, or telephone check (where payment is made by using your checking account number and bank routing number) do not count against the six-transaction limit. You cannot withdraw money or make payments more than six times a month from a money market account by check, debit card, draft, or electronic transfer. While searching for what a money market savings account is, you may have come across another type of savings account called a certificate of deposit, or a CD. Capital One 360 offers one of the best APYs for a 12-month CD. With a Capital One 360 Money Market account, you need a balance of at least 10,000 to get the highest rate. If you have at least 10,000 to deposit, Capital Ones money market account offers the best APY with no monthly service fee. Like a regular savings account, a money market account at a bank is insured by the Federal Deposit Insurance Corporation (FDIC), while one at a credit union is insured by the National Credit Union Administration (NCUA). Depending on the account, this could be a few hundred dollars or more than 10,000. Money market accounts are sometimes called money market deposit accounts or money market savings accounts.

0 kommentar(er)

0 kommentar(er)